Where Can I Download Mat B1 Form For Paternity

This page contains information on: • • • • • • • • • April 2017 This information sheet outlines how to qualify for maternity leave and pay if your baby is born prematurely. It also covers how to give notice to your employer for leave and pay and outlines other options for taking leave to look after your baby. Premature birth A premature birth is considered to be a birth before the start of the 37 th week of pregnancy. Unfortunately mothers whose baby is born prematurely are not currently entitled to any extra maternity leave or pay. If your baby is born very early, for example, when you are still at work or before your maternity leave has started you may be uncertain about how to give notice to start your maternity leave and pay and you may be wondering about how to stay off work longer with your baby.

He asked me last night when I'm getting my Mat B1 form, as apparently thats what he needs to hand in, by Tuesday do he can get paid paternity leave. Im not even in London on Monday. Given the timescale you have I would download it and take it in ASAP so there can't be any further delays. And National Insurance. You must tell her if she does not qualify for SMP by giving her a form SMP1 which will help her apply for Maternity Allowance. If she cannot get. SMP from you, you must also give her back the maternity certificate (MATB1). There is an HMRC calculator and standard letters, including SMP1, you can.

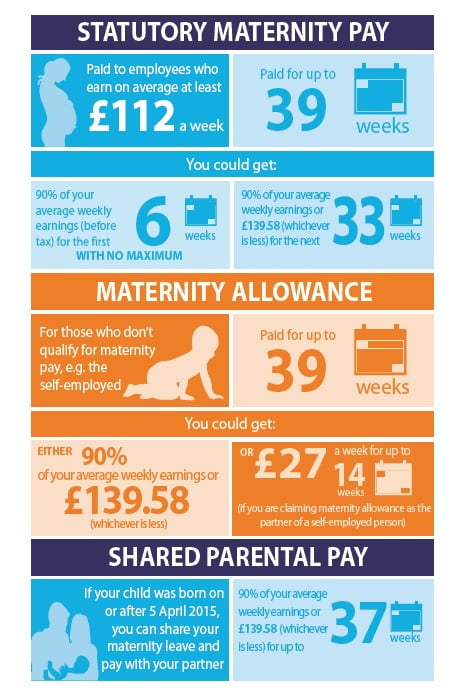

For more information on how to give notice to your employer for maternity leave and pay if your baby is born early, see the section below on Notice. For more information on other options for extending your time at home with your baby, see the section below on Other rights to time off for parents. Maternity leave and pay following a premature birth • All employees have the right to 52 weeks maternity leave. • Statutory Maternity Pay (SMP) and Maternity Allowance (MA) are paid for 39 weeks to women who meet the qualifying conditions. • SMP and MA are not classed as public funds.

• Agency workers, casuals and zero hours workers are not entitled to maternity leave, unless it is stated in your contract, but you can still get maternity pay under the normal rules, see below. • You are protected against unfair treatment and unfair dismissal because of your pregnancy, childbirth and absence on maternity leave. Maternity leave When does my maternity leave start if my baby is born early? All employees qualify for maternity leave from day one of their employment. Maternity leave gives you the right to take up to 52 weeks off work, with the right to return to the same job. Unfortunately there is currently no right to extra leave for babies born prematurely. The earliest you can choose to start your maternity leave is 11 weeks before your baby is due.

It is up to you to decide when you want to start your maternity leave and you must give your employer notice of the date you want to start your maternity leave by the end of the 15 th week before your baby is due. If your baby is born prematurely and you have not yet started your maternity leave, your maternity leave will start on the day after the birth. There is no flexibility over the start of your leave as it is compulsory to be off work for the first two weeks after childbirth (four weeks if you work in a factory). See Notice below on how to give your employer notice of the start of your maternity leave if your baby has been born early. Once your maternity leave has started it will run for up to 52 weeks. You do not need to give notice to return to work unless you wish to return before the end of the 52 week period in which case you must give at least eight weeks’ notice to return to work early. Confusingly, the rules on maternity leave and maternity pay are different and you need to check whether you are entitled to each right separately.

All employees are entitled to maternity leave but agency, casual and zero hours workers are not entitled to leave (unless your contract specifically says so) but can still qualify for maternity pay. As maternity pay only lasts for 39 weeks the last 13 weeks of maternity leave are unpaid. The section below outlines how to qualify for maternity pay and the section at the end of this information sheets looks at benefits for low income families. Check first to see if you qualify for Statutory Maternity Pay and if you do not qualify for SMP, check to see if you can get Maternity Allowance. My baby died shortly after the birth. What happens to my maternity leave and pay? You are still entitled to your maternity leave and pay once you have qualified for it and it is up to you to decide how long you want to stay on leave.

If you do not want to stay off work for the full 52 weeks you can give 8 weeks’ notice to return to work early. Maternity leave and pay must be given for all live births, even if your baby only lives for a short time, as long as you meet the conditions. You can still qualify for maternity leave and pay if your baby is stillborn from the end of the 24 th week of pregnancy.

This also applies to paternity leave and pay for your partner. For more information on maternity rights following a miscarriage, still birth or neonatal death, see the information sheet How to qualify for Statutory Maternity Pay (SMP) Can I get SMP? You can get SMP if you are an employee or worker, such as a casual or agency worker and your employer pays you through PAYE and deducts any tax or National Insurance and you meet the qualifying conditions below. You can get SMP if: • you have been employed by the same employer for at least 26 weeks by the end of the 15th week before your expected week of childbirth. If you give birth before the 15 th week before your expected week of childbirth you can still qualify if you would have continued to have been employed up to the 15 th week before the EWC. • you are still employed in the same job in the 15th week before your expected week of childbirth. You are counted as being in work that week even if you only work for one day or part of a day that week or you are off sick or have given birth.

• you actually receive at least £113 (before tax) per week (April 2017 – April 2018) in earnings, on average in the eight weeks (if you are paid weekly) or two months (if you are paid monthly) up to the last pay day before the end of the 15 th week before your baby is due. If you give birth early your employer must use your average earnings for the eight weeks ending with the week immediately before the week you gave birth.

How to work out the 15th week before the expected week of childbirth Find the Sunday before the day your baby is due or the due day if that is a Sunday. Count back 15 Sundays from there. This Sunday is the start of the 15 th week before the week your baby is due – it is known as the Qualifying Week. What is Statutory Maternity Pay?

SMP is paid for 39 weeks. SMP is paid at two rates: for the first six weeks you get 90% of your average pay. The average is calculated from the pay you actually received during the eight week calculation period. After that you get a flat rate of £140.98 per week (April 2017 – April 2018) for 33 weeks or 90% of your average earnings if that is less. Your employer pays your SMP in the same way as your salary is paid. They deduct any tax and National Insurance contributions. Your employer can claim most or all of your SMP back from HM Revenue and Customs (HMRC).

You can get SMP even if you do not plan to go back to work. You do not have to pay SMP back if you do not return to work.

SMP is NOT classed as public funds. You are entitled to SMP if you meet the normal qualifying conditions. For more information, see the Maternity Action information sheets on maternity and parental rights for migrants subject to immigration control. When will my SMP start if my baby is premature? The earliest you can choose to start your SMP is 11 weeks before the expected week of childbirth.

You can work right up until the date the baby is born, unless: • you have a pregnancy-related illness/absence in the last 4 weeks of your pregnancy or • your baby is born before you have started your maternity leave. If you are off sick with a pregnancy-related illness in the last four weeks of pregnancy, your SMP will start on the day after your first day of absence from work. So, if you phone in sick on a Wednesday, your SMP period will start on Thursday. If you give birth before the start of your maternity leave, your SMP period will start on the day following the actual date of birth.

You must still give your employer notice that your baby has been born and that you are now on maternity leave and wish to receive your maternity pay, see Notice below. I don’t think I will qualify for SMP?

If you are not sure if you are entitled to SMP, you should ask give your employer your notice for maternity leave and/or pay and ask your employer to work out whether you qualify. If you do not qualify for SMP your employer must give you form SMP1 to explain why and you should claim Maternity Allowance instead.

The SMP1 should be issued within 7 days of deciding that you do not qualify. If your employer is not sure how to work out your SMP or how to claim it back, they can ring the HM Revenue & Customs Employers’ Helpline on 0300 200 3200 for advice. For more information on maternity pay, see. What earnings are used in the calculation for SMP?

Your average weekly earnings for SMP will be based on all your earnings that are subject to National Insurance contributions. Therefore, your earnings can include overtime, commission, bonuses or other sums paid during the SMP calculation period on which National Insurance contributions are paid. In some cases you may benefit from an increase in earnings which will increase the amount of SMP you receive or sometimes your SMP can be reduced if your earnings are lower than normal during the SMP calculation period.

Unfortunately the rules on calculating SMP are very rigid and your employer will not have any discretion if your earnings are lower than normal in the SMP calculation period. If you are concerned that your employer has not calculated your average earnings correctly you can ask your employer to check with the HMRC Employer’s Helpline 0300 200 3200 or you can get a formal decision from your local HMRC Officer. My employer says I do not qualify for SMP because I was off sick during my pregnancy. What can I do? If you received Statutory Sick Pay (SSP) during all of the weeks used to calculate your average earnings for SMP you will not have earned enough to qualify for SMP and you should claim Maternity Allowance instead. Your employer should give you form SMP1 explaining why you did not qualify for SMP.

If you received SSP during part of the period used to calculate your average earnings, your SMP may be reduced. For more information, see If your income is reduced you may be able to claim other benefits, see below. Can an agency worker get SMP? Agency workers, casual and zero hours workers can claim SMP if you are paid through PAYE with tax and National Insurance deducted at source and you meet the normal qualifying conditions.

You will be treated as having 26 weeks continuous employment even if you were unable to work because of sickness, annual leave, pregnancy or there was no work available in any particular week. There are special rules on continuous service for temporary and seasonal workers which may allow you to count weeks when you were not working. If you are refused SMP because of breaks in your employment record your employer should give you form SMP1. You can ask your employer to check your entitlement to SMP with the HMRC Employer’s Helpline and if you disagree you can ask your local HMRC Officer for a formal decision. If you cannot get SMP, you may qualify for Maternity Allowance instead. For more information see or What can I do if my employer does not pay SMP correctly? If you think that your employer has made a mistake or you are having difficulties with your employer paying SMP you should write to your employer or make a formal complaint.

If you and your employer do not agree, you can ask your local HM Revenue and Customs Officer to make a formal decision. You must request this within 6 months.

If HMRC order your employer to pay your SMP, your employer can be fined for failure to pay it. If your employer does not pay your SMP it will be paid by the Statutory Payments Disputes Team, see Where to go for more help. You can also make a claim in an employment tribunal for unlawful deduction of wages if your employer does not pay all or part of your SMP or you are treated unfairly during maternity leave.

You must make a tribunal claim within three months, less one day. You must contact ACAS Early Conciliation on 0300 123 11 00 before making a tribunal claim. For more information, see How to qualify for Maternity Allowance (MA) Can I get MA? You can get MA if you have changed jobs during pregnancy or you do not earn enough to get SMP or you are unemployed or self-employed during pregnancy. To get MA: • you need to have been employed or self-employed for at least 26 of the 66 weeks before the expected week of childbirth, and • you can find 13 weeks (not necessarily in a row) in which you earned over £30 per week on average.

You should choose the weeks in which you earned the most. You can add together earnings from more than one job. You can include employed and self-employed work. You can also claim MA if you are the spouse or civil partner of a self-employed person and you help in their business. MA is paid by the Jobcentre Plus for 39 weeks. Afrojack No Beef 320kbps Download. MA is £140.98 per week (April 2017 – April 2018) for 39 weeks or 90% of your average earnings if that is less.

If you are claiming MA as the spouse or civil partner of a self-employed person, it is payable for 14 weeks at the rate of £27 per week. MA is NOT classed as public funds. You can claim MA if you meet the normal qualifying conditions.

For more information, see the Maternity Action information sheets on maternity and parental rights for migrants subject to immigration control. When will MA start if my baby is premature?

The earliest you can choose to start MA is 11 weeks before your expected week of childbirth. If your baby is born prematurely your maternity leave and MA will start the day after the day your baby is born. You must still give your employer notice to take maternity leave and contact the Jobcentre Plus to ask them to start paying your MA. How do I claim MA? The earliest you can claim MA is 14 weeks before your baby is due. You should put in your claim form as early as possible and notify the Jobcentre Plus of the date you intend to stop work. If you have not yet applied and your baby is born early you should make a claim as soon as possible.

MA can only be backdated for a maximum of three months so you may lose some MA if you apply late. You will need to provide your MATB1 maternity certificate showing your due date.

If you are claiming Maternity Allowance because your baby has been born early you will need to provide proof of childbirth. This could be a certificate from the hospital or from your GP or midwife or your baby’s birth certificate. If you are employed, you will need to ask your employer for form SMP1 (explaining why you do not qualify for SMP). If you are not sure if you will qualify for MA you should make a claim so that Jobcentre Plus can make a decision about your entitlement. You can download a claim form (MA1) from gov.uk or call the the JobCentre Plus claim line on 0800 055 6688 to request a claim pack. If you are not entitled to MA, Jobcentre Plus should automatically use the same claim form to check whether you can get Employment and Support Allowance instead (see section below). You should also give your employer notice to start your maternity leave by the 15th week before your baby is due (see the box above on how to give notice above).

What can I do if I do not receive the correct amount of MA? If you are not happy with a decision about your Maternity Allowance you can ask for a mandatory reconsideration. You must do this within one month of the date of the decision letter. If you are still not happy after the mandatory reconsideration you can ask to appeal.

Is there anything I can get if I don’t qualify for SMP or MA? You may be able to get Employment Support Allowance (ESA) on maternity grounds if you do not qualify for SMP or MA but have done some work in the last three years but not recently. You do not need to do a Work Capability Assessment as you will need to provide your MATB1 maternity certificate. You can get ESA if: • you have paid or been credited with enough National Insurance contributions during the last three tax years that do not overlap the current calendar year, or • your household income is low enough If you think you might qualify for Maternity Allowance you should claim MA first and if you do not qualify Jobcentre Plus must look at your contribution record to see if you can get ESA on maternity grounds. You do not need to make a separate application.

If you know that you do not qualify for Maternity Allowance, you can make a claim for ESA by calling the Jobcentre Plus claim line on 0800 055 6688 or by downloading a claim form from. For more information on claiming ESA on maternity grounds, see the information sheet Self-employed What can I claim if I am self-employed? You may be entitled to Maternity Allowance if you meet the normal conditions.

You do not need to prove your earnings when claiming MA as the JobCentre Plus will check your NI contributions record. A self-employed woman is treated as having the following earnings regardless of the amount you actually earn unless you do some employed work as well: • If you pay a class 2 NI contribution, you will be treated as earning enough to qualify for the maximum rate of MA. You will be entitled to MA of £140.98 per week (April 2017-April 2018). • If your earnings are below the small profits threshold, you will be treated as earning £30 a week (the MA threshold). You will be entitled to MA of £27 per week (90% of your deemed average earnings). You can only receive a higher rate of MA if you can add any employed earnings.

Following changes to the collection of Class 2 National Insurance contributions, if you have not yet had the opportunity to make a Self-Assessment tax return and pay Class 2 NICs and you wish to make a claim for Maternity Allowance you should contact Jobcentre Plus and make your claim for MA as soon as possible as you will be given the opportunity to pay Class 2 NICs before they are due in order to qualify for MA at the standard rate of £140.98. Jobcentre Plus will contact HM Revenue & Customs who will check your NICs record. HMRC will let you know how to make an early payment of Class 2 NICs in order to bring your contributions up to date and enable you to claim MA. If you have submitted your tax return before you claim MA and your earnings were below the small profits threshold so you were liable for Class 2 NICs you will receive MA at the lower rate of £27. However, if you have not submitted your tax return before your claim MA, and are then given the option to make an early payment of NICs; if you pay this bill you will be eligible for the standard rate of £140.98 which can be backdated to the start of your Maternity Allowance period.

How to give notice for leave and pay if your baby is born early Do I have to give notice if my maternity leave started when my baby was born? Yes, you still need to notify your employer to tell them that your baby has been born early and that you are now on maternity leave. See the next question for what you need to tell your employer in your notice for maternity leave and pay.

The law says that you are only entitled to maternity leave and pay if you have given notice to your employer so it is very important that you tell your employer as soon as you reasonably can. Your employer cannot refuse to give you leave and pay but your maternity pay will only start once you have given notice. What do I have to tell my employer when I give notice for maternity leave and pay? To get maternity leave you must normally give your employer the following information in or before the 15th week before your baby is due (if your employer asks you to, you must put it in writing): • that you are pregnant • the expected week of childbirth • the date on which you intend to start your maternity leave (which cannot be before the 11 th week before your expected week of childbirth unless your baby is born earlier).

If you are not able to give notice by the 15 th week before your baby is due, you should give notice as soon as reasonably practicable. If you have already given your employer notice as above and your baby is born before the date you planned to start your maternity leave, you must contact your employer and tell them the date your baby was born and that your maternity leave and pay must start from the day following the birth (not the day you had planned). You should do this as soon as reasonably possible.

If your baby is born before the 15 th week before the expected week of childbirth you must contact your employer and tell them the date your baby was born and that your maternity leave and pay must start the day following the birth. To get SMP/Maternity Allowance you MUST give your employer/Jobcentre Plus a copy of your maternity certificate (form MAT B1) stating your expected week of childbirth which your midwife or GP can provide. If you have not already given your employer your MATB1 maternity certificate you must give it to your employer within three weeks of your maternity pay starting or up to 13 weeks from the start if there is a good reason for the delay. If your baby is born before the 15 th week and before the expected week of childbirth or before the date you had planned to start your maternity leave, your employer/Jobcentre Plus can ask for evidence of the week of childbirth in order to pay SMP/Maternity Allowance. This could be a certificate from the hospital or from your GP or midwife.

If you provide a copy of your baby’s birth certificate an employer is only allowed to keep a record of the date of birth and is not allowed to keep a copy of the birth certificate. You must put your notice for maternity leave and pay in writing (as above) if your employer asks you to. Your employer cannot ask for any other documentation.

Once you have given notice, your employer must write to you within 28 days and state the date you are expected to return from maternity leave (52 weeks from the birth). Other rights to leave Shared parental leave Can I take shared parental leave (SPL) and pay? You or your partner can take shared parental leave and pay if you both qualify. If you qualify for maternity leave and SMP and your partner qualifies for paternity leave and Statutory Paternity Pay, you will both qualify for shared parental leave and pay. You can take the shared parental leave together or separately. For example, the mother can reduce her maternity leave by four weeks so that her partner can take four weeks’ shared parental leave immediately after his paternity leave. Shared parental leave can only be taken within 52 weeks of the birth of your baby.

It does not give you any extra leave but it does give you a bit more flexibility. Shared parental leave allows the mother to take leave more flexibly than in one block of maternity leave or it allows the mother to give some of her leave to her partner.

The mother must return to work early or reduce her maternity leave/SMP period for her partner to take shared parental leave. For more information, see Our baby has been born very early. Can we change the dates of my partner’s shared parental leave? Yes, you can change the dates of SPL by giving at least eight weeks’ notice. If you or your partner have booked shared parental leave within the eight weeks following the expected week of childbirth and your baby is born at any time before the week your baby was due, you or your partner (whoever was booked to take the leave) can change the date of the shared parental leave. If the shared parental leave was booked for two weeks after the expected week of childbirth, it can only be changed to two weeks after the date of birth. If you or your partner are unable to give the employer eight weeks’ notice of the change in date, notice should be given as soon as reasonably possible after the date of birth.

Can I still take shared parental leave if I gave a notice of intention to take SPL but I had not yet given notice to book SPL before my baby was born prematurely? Yes, you can still take SPL by giving at least eight weeks’ notice to book SPL.

If your baby is born at least eight weeks before the expected week of childbirth and you want to take your SPL within eight weeks of the birth you can still take it as long as you give notice as soon as reasonably practicable after the birth. Our baby was born before we were able to give notice of intention to take SPL, can we still share some leave? Yes, you can still take SPL by giving at least eight weeks’ notice. If your baby is born more than eight weeks before the expected week of childbirth and either of you want to take SPL within eight weeks of the birth, you or your partner can take shared parental leave as long as you give the correct notices as soon as reasonably practicable after the birth. Other types of leave Do I have any rights to take a longer period of leave? Unfortunately maternity leave and pay cannot be extended if your baby is born prematurely but you could look at some of the other options for taking more time off work. Sick leave If you are not well enough to return to work after maternity leave you are entitled to take sick leave.

You should follow your employer’s normal sickness reporting procedures. If your employer provides contractual sick pay you are entitled to it in the usual way. If you are normally paid Statutory Sick Pay you may not qualify if you are returning to work after a period of unpaid leave. Your period of sickness must also begin after the end of your maternity leave in order to qualify for SSP. For more information see Annual leave You can ask your employer if you can take annual leave immediately after your maternity leave. Your normal holiday entitlement continues to accrue during maternity leave so you may have some holiday owing to you.

All employees are entitled to at least 28 days paid annual leave a year (pro rata for part time staff). This can include paid Bank Holidays (you can check your contract or ask your employer).

Annual leave should be agreed with your employer in the normal way and you should not be treated less favourably because you have been away on maternity leave. Unpaid leave You can ask your employer if they will agree to a further period of unpaid leave. Your employer does not have to agree to it.

If your employer does agree to further unpaid leave ask your employer to confirm the agreement in writing including the period of leave agreed and confirmation that you will have the right to return to the same job. Parental leave If you and your partner have worked for your employer for at least a year you are both entitled to Parental leave. You are entitled to take up to 18 weeks Parental leave, per parent, per child, up until your child’s 18th birthday. The right to Parental leave comes from EU law and is different from the right to share leave under shared parental leave.

Parental leave can normally only be taken in blocks of a week, up to four weeks a year but your employer may be more flexible. You must give at least 21 days’ notice to take Parental leave. Parental leave is usually unpaid unless your employer offers paid leave. If you are taking Parental leave of more than four weeks in a row you still have the right to return to the same job but your employer can offer a suitable alternative job if there is a good business reason why you cannot return to your old job. For more information on Parental leave see What happens to my annual leave if I have been on maternity leave and sick leave for a long time?

You continue to accrue annual leave during sick leave and maternity leave. This means that you continue to build up your normal holiday entitlement as it you were still at work. Under the Working Time Regulations all workers are entitled to 28 days statutory annual leave (pro rata for part time staff). If you get more than 28 days holiday a year, the extra leave is contractual leave which is provided by your employer. If you have been away from work for a long time because of sick leave and/or maternity leave, you may have accrued a large amount of leave. You will need to discuss with your employer when you can take this leave.

You can take annual leave during sick leave, so you could ask to receive some paid holiday during your sick leave. You are entitled to carry forward 20 days annual leave if you cannot take it because of sick leave. Can I ask to return to work on reduced hours? Yes, you can make an application for flexible work if you would like to return to work part-time or you want to ask for changes to your hours, days or place of work. Your employer must consider your application reasonably and give you a decision within three months.

They can only refuse for a good business reason. This usually results in a permanent change to your contract. If you only want a temporary reduction in hours you should talk to your employer about a phased return to work e.g. Part-time for the first six months. For more information, see Paternity leave What happens to my partner’s paternity leave if our baby has been born early?

Fathers and partners (including same sex partners) can start their paternity leave on the day the child is born or take paternity leave up to 56 days from the birth. If your baby is premature, paternity leave can be taken up to 56 days from the due date. Paternity leave can be one or two weeks and must be completed within the 56 day period. If your partner has already given notice of when s/he wants to start paternity leave and your baby is born early, your partner must contact their employer as soon as reasonably possible and tell them that your baby has been born.

Your partner can vary the date s/he wants to start paternity leave by giving their employer at least 28 days’ notice. If it’s not possible to give 28 days’ notice, s/he should give notice as soon as reasonably possible. If your partner has not yet given notice and your baby is born early, s/he must contact their employer as soon as possible and give notice of when they want to take paternity leave.

If your partner has chosen to start paternity leave on the day your baby is born and s/he is at work on that date, paternity leave will start the following day. Fathers and partners are also required to give their employer notice of the date the child was born. All notices, as above, must be in writing if the employer asks for it and should be given within 28 days of the birth.

For more information on paternity leave see My baby was born before the 15 th week before the expected week of childbirth, can my partner still get paternity leave? Your partner is still entitled to paternity leave and pay if s/he would have been employed for 26 weeks by the 15 th week before the expected week of childbirth and his or her average weekly earnings are at least £113 per week (April 2017 – April 2018) in the eight weeks up to the week before the week your baby was born. Benefits Other benefits payable during the maternity pay period Once your baby is born you can claim Child Benefit.

Families in receipt of Child Benefit will be subject to a high earner child benefit charge if one or more parent earns over £50,000. Working and non-working families may be able to claim Child Tax Credit and/or Working Tax Credit depending on your family income.

For more information and an application form, telephone the Tax Credit Helpline on 0345 300 3900. If you are not working, you may be able to claim Income Support after the birth of your baby. These benefits (not Child Benefit) are gradually being replaced by Universal Credit.

If you or your partner are receiving Income Support, income-based Jobseekers Allowance, Child Tax Credit of more than the family element or Universal Credit you may be entitled to a Sure Start Maternity Grant of £500 for your first child (or if there are no other children aged under 16 in your family) or first multiple birth. Claim on form SF100 (Sure Start Maternity Grant), from 11 weeks before the baby is due until 3 months after the birth. You can download a claim form from or call the Jobcentre Plus claim line on 0800 055 6688 to request a form. For more information on benefits, see Money for Parents and Babies. Where to go for more help Maternity Action Advice on maternity and parental rights and benefits Helpline 0808 802 0029 (Wednesday 10am – 2pm, Thursday 3pm – 7pm, Friday 10am – 2pm) Maternity Care Access Advice Line Advice on access to maternity care and charges for NHS care for women from abroad: 0808 800 0041, Thurs 10 – 12. ACAS For advice on employment rights or for Early Conciliation if you are thinking of making a tribunal claim Helpline: 0300 123 11 00 (offers telephone interpreting service) Best Beginnings Information and support for parents whose baby is premature or sick.

BLISS Charity providing support and information for premature births. Helpine: 0808 801 0322 Citizens’ Advice For information about your rights and to find details of local advice bureau Factsheets available in English, Welsh, Bengali, Gujarati, Punjabi, Urdu and Chinese The CAB is currently developing a national advice phone service. If you live or work in Wales call 08444 77 20 20. For England, call 08444 111 444 or check your local bureau’s contact details as it is not available in all areas yet. Civil Legal Advice If you are eligible for legal aid you can get free legal advice on 0345 345 4 345 (offers translation service). To check your eligibility see To search for specialist legal advisers or solicitors in your area see Equalities and Human Rights Commission (EHRC) For information and advice about discrimination law Equality Advisory Support Service Help and advice on discrimination and human rights Helpline: 0808 800 0082 Textphone: 0808 800 0084 Mon.- Fri. 9am – 7pm Sat.

10am – 2pm GOV.UK The government’s online information service JobCentre Plus Claim Line Telephone for new benefit claims, including Maternity Allowance, 0800 055 6688 Mon.– Fri. 8am – 6pm For existing Maternity Allowance claims 0345 608 8610 Universal Credit Helpline 0345 600 0723 HMRC Tax Credit Helpline: 0345 300 3900. For information and claims for Working Tax Credit and Child Tax Credit.